Frequently Asked Questions

When switching between portals, you may sometimes encounter a blank page, or be stuck on a "spinning wheel" page. If you are able to access the portal through your browser's private mode, such as Chrome's Incognito or Firefox's Private Browsing, it typically means you need to clear your browser cache.

To resolve the issue, clear your browser's cache with the time range of All Time or Everything:

Caution

You will only be able to refund payments if your account has been added to a security group with that permission.

Go to the View Folders page and find the folder containing the payment. Click on the folder name to access its Folder Maintenance page.

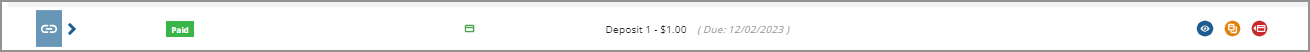

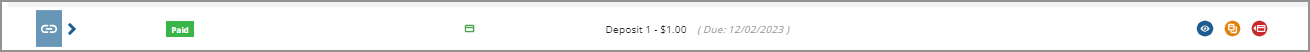

Find the payment on the page. Payments are indicated by a credit card icon in the Type column.

Under the Action column, click the red Refund icon.

If the original payment was surcharged, the refund amount will also include the surcharged amount.

Caution

You will only be able to clone payments if your account has been added to a security group with that permission.

Go to the View Folders page and find the folder containing the payment. Click on the folder name to access its Folder Maintenance page.

Find the payment on the page. Payments are indicated by a credit card icon in the Type column.

Under the Action column, click the orange Clone icon.

If the original payment was surcharged, the cloned amount will also include the surcharged amount.

Ensure the account that needs to access the credit card number is in the correct security group.

Open the folder containing the transaction for which you need to access the credit card number.

Click the blue credit card icon.

You'll be greeted with a window asking for a PIN number. Check your email for a message containing this number.

Enter the PIN into the verification window. You'll then have 60 seconds with which to view the credit card number.

For help with reducing chargebacks, refer to the Chargeback Prevention Tips guide.

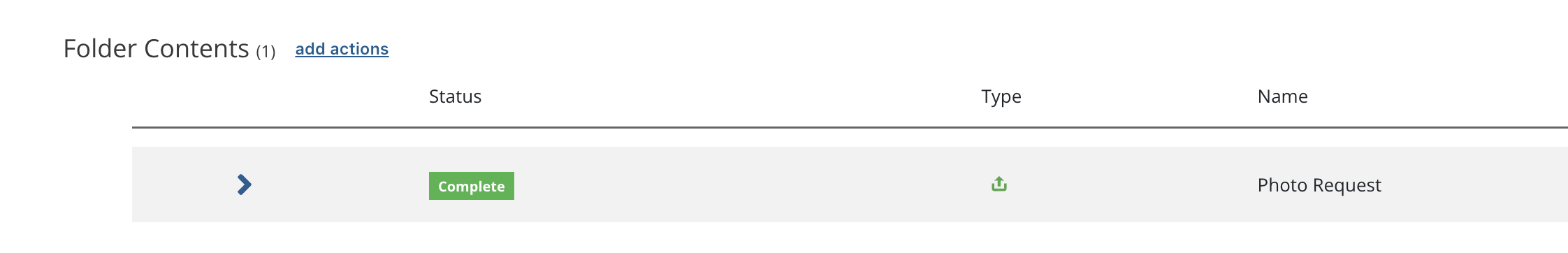

If you sent an upload request with a signature document, you can access the file your participant upload by clicking the green upload icon next to the document name.

There are numerous differences between paying with a credit card versus paying by ACH. Key factors include:

The processing costs to the merchant – ACH payments usually have lower processing fees than credit cards.

The processing times for the transaction – Credit cards are much faster to process, which in turn means your property is paid faster.

Customer preference or needs – some customers prefer to pay by ACH because they don't want to use a credit card, or don't have one. Others may prefer to use a credit card so they can earn reward points or save cash.

Sertifi Payments accepts both forms of payments so that merchants and customers can pay and get paid in the manner they prefer.

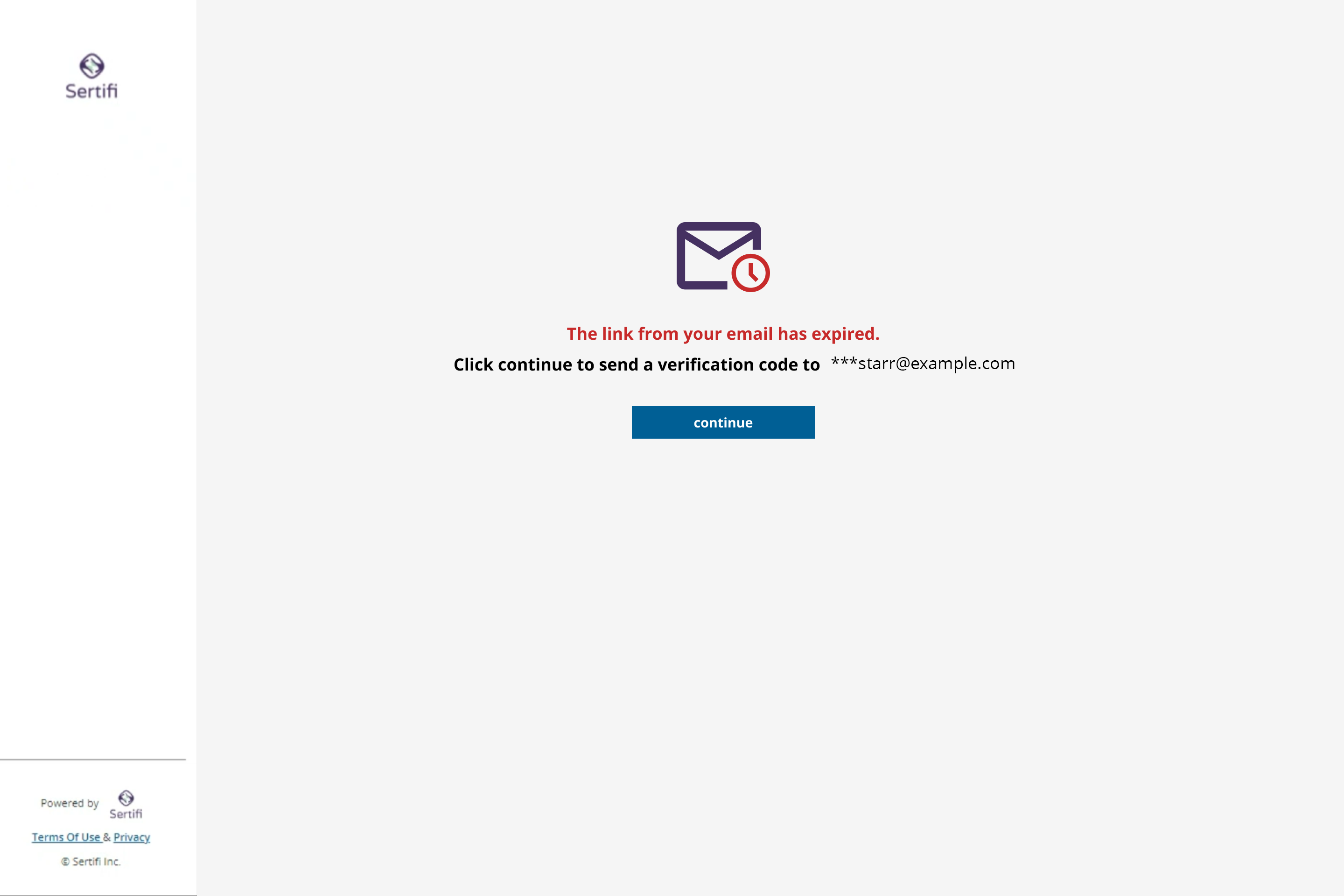

A link to a signature document, payment request, or folder will expire 5 days after it's sent, or receiving 5 clicks. To request a new link:

Try to access the folder from the link you were using. If you see this screen, click Continue. A PIN code for requesting a new link will be sent to your email.

The PIN should arrive in your inbox in a few minutes.

Input the PIN code and click Verify Code. If successful, you can then access the folder's contents. If you were not successful, you'll have 5 more attempts to try the PIN code.

If you exceed the number of allowed attempts, you'll need to directly contact the person sent you the folder in order to access it.

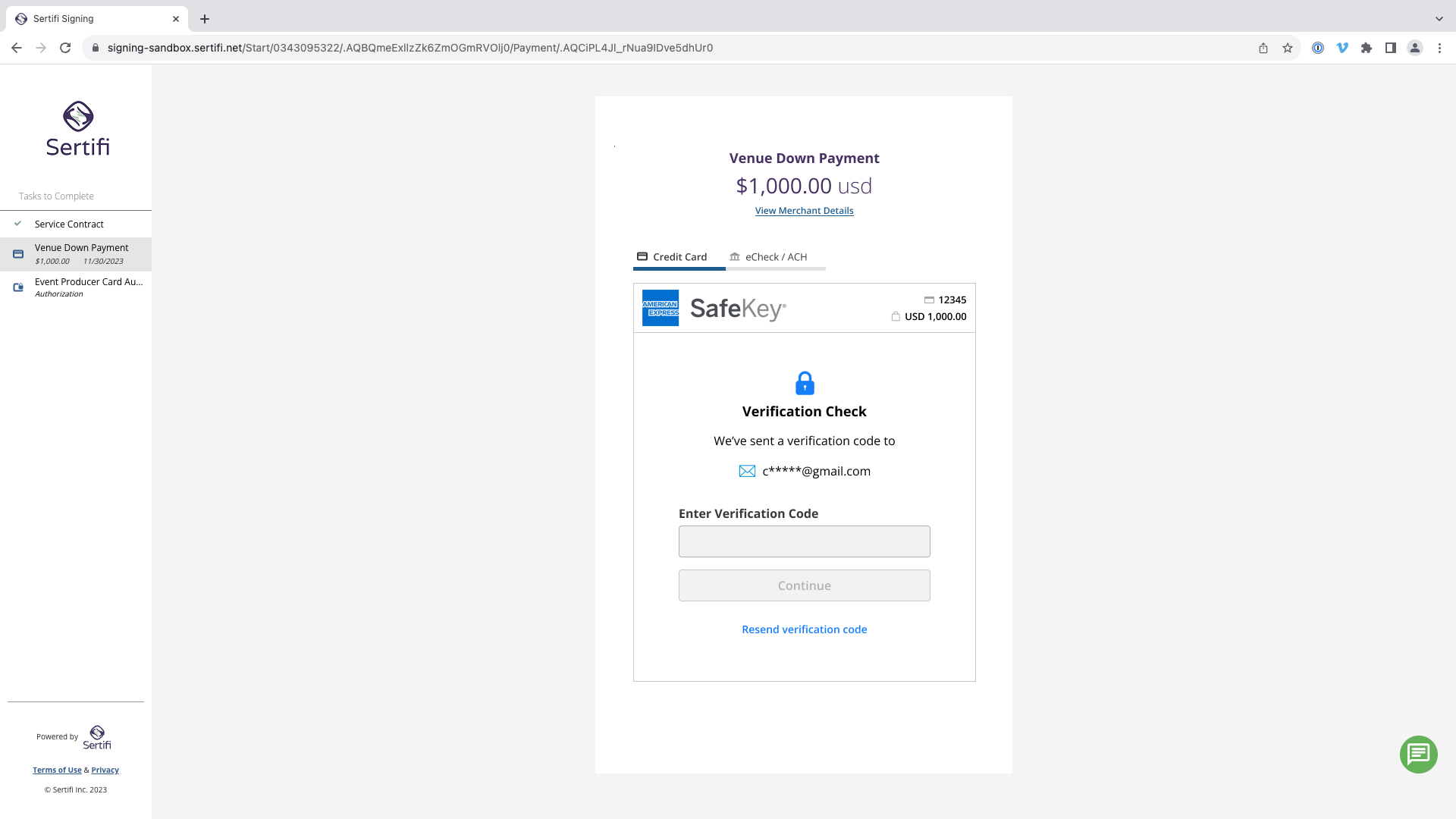

A customer may need to provide some identifying information in order to prove they're authorized to use a payment card. This information can include:

A PIN

Personal identification information, such as a name, address, phone number, or postal code

Authentication codes sent by SMS, phone, email, or an app notification

3DS checks may also require a cardholder to authenticate via:

Scanning a QR code

Logging in to their bank's website or mobile application

Answering challenge questions

Passing a biometric authentication

If a cardholder is having trouble passing the 3DS check, possible solutions include:

Verifying their payment details on the payment form by confirming that the card number, expiration date, and CVV are entered correctly.

Confirming that the billing address and phone number matches what's on file at their bank, which may include having to update their billing address or phone number at their bank

Contacting their bank to ensure the card is authorized for online transactions, as this is a common scenario with corporate cards that may have restrictions to prevent unauthorized use.

Trying a different card or a different payment method, such as ACH.