Advanced Fraud Tools

Sertifi Advanced Fraud Tools bring a higher level of security and reliability to Sertifi Authorizations. With a combination of smart technology and data analysis, these tools automatically assess new transactions for signs of potential fraud.

Advanced Fraud Tools are currently only available in Authorization workflows.

Using Advanced Fraud Tools

Advanced Fraud Tools is included with every eAuthorizations portal, and will always automatically run in the background to assess an authorization for signs of fraud.

If you don't receive a fraud score for each authorization, or if Advanced Fraud Tools doesn't otherwise appear to be running, contact Support.

Warning

Advanced Fraud Tools will never enable nor prohibit the ability to proceed with a transaction. Always refer to your organization’s policies before making a decision.

Warning

This score is for internal use only, and should never be shared with a cardholder.

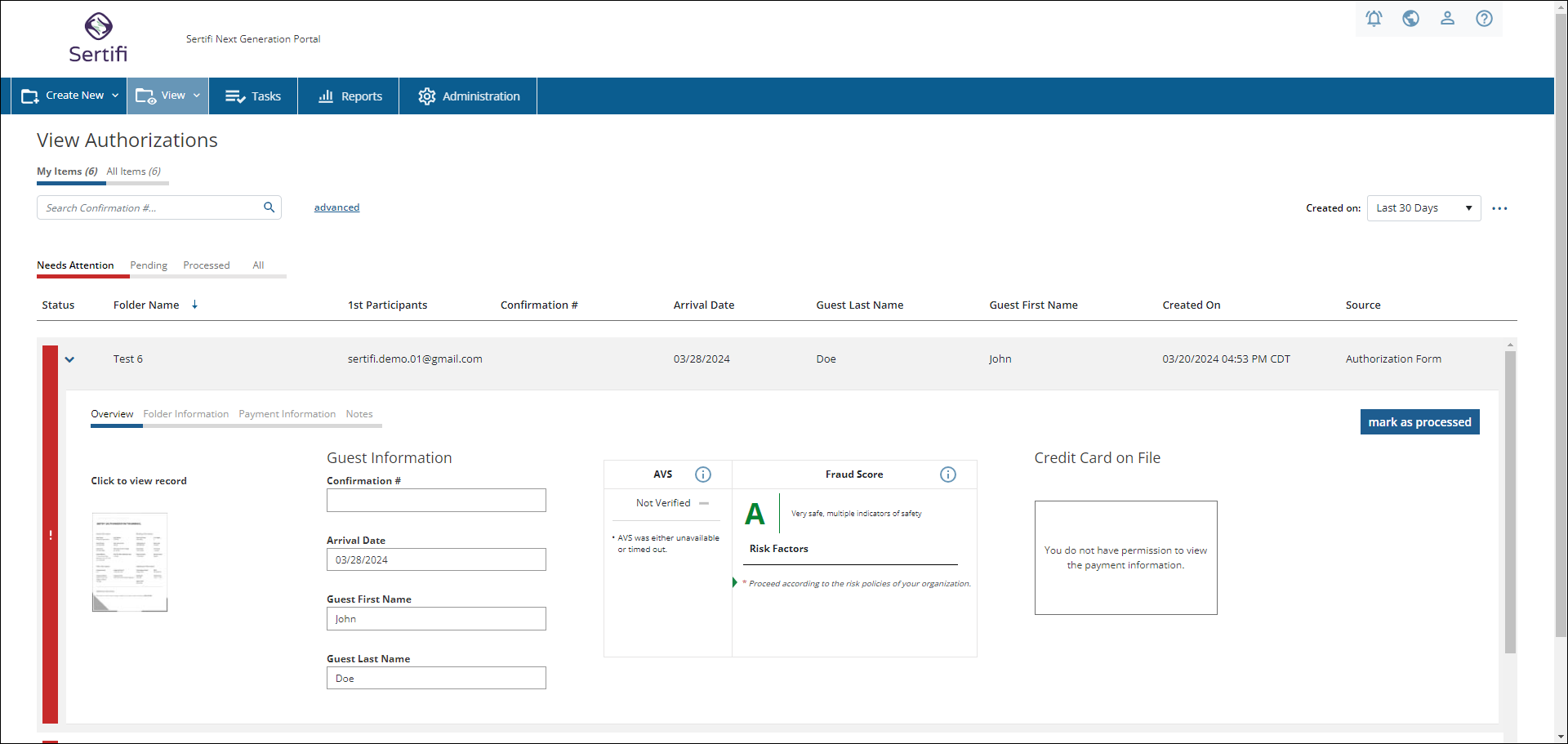

Understanding the Fraud Score

For each authorization in a folder, you'll see a letter grade in the Fraud Score column on the Folder Maintenance page. This grade is an estimation of the overall safety of the authorization request.

Authorization requests rated A, B, or C have multiple indicators that it's safe to proceed with the transaction.

Authorizations with D grades are likely safe, but notably affected by one or more risk factors.

The riskiest authorizations are rated F.

Risk Factors & Descriptions

Multiple factors are considered when determining a Fraud Score. These factors include, but are not limited to:

Card authorization status (approved or not approved as determined by the bank or financial institution that issued the card)

The payer's billing ZIP code

Payer IP address

CVV verification results. A successful verification will improve the fraud score, and an unsuccessful or failed verification will lower the score.

The payer email address, including factors like the length of time that the address has existed, and the domain for the email address.

Note

Common or free-to-use email domains, like Gmail or Hotmail, aren't necessarily warning signs for fraud. However, it's worth taking a second look if customers are using a free-to-use email provider while paying with a company or government card.

Tip

For authorizations deemed as medium or high risk, Advanced Fraud Tools will always display one or more reasons explaining why a low score was assessed.

Risk Factor | Description |

|---|---|

This card has a history of chargebacks in the network. | The given payment card has a history of chargebacks within its card network (Visa, Discover, Amex, etc.) |

This card has a history of chargebacks with this merchant. | The given payment card has a history of chargebacks within your own payment system, or payment gateway. |

The email address is brand new. | A recently-created email address can sometimes be the sign of a fraudster trying to cover their tracks. |

This customer performed more than 7 transactions over the past two weeks. | A high volume of transactions can indicate a fraudster attempting to test a payment card, or attempting to extract as much value from the card as possible before it's deactivated. |

This customer is associated with 4 or more unique devices. | A common fraud vector is evading detection by using multiple computers, phones, or other devices to attempt a transaction. |

This customer is associated with 5 or more unique email addresses. | Most individuals only use one or two different email addresses depending on their needs. A greater number of email addresses can be a cause for suspicion. |

User's IP is associated with known fraud. | The user's IP address has already been identified as a source of fraud. |

User is accessing via uncommon Internet access method. | The user is accessing the payment form via an unusual Internet connection, such as a VPN or unsecured public network. |

Mismatch between Billing Country and Credit Card Origin Country | The credit card was issued in one country, but the billing address is located in a different country. For instance, this might be a card issued by an American bank, but with a billing address located in Canada. |

User is using a corporate/government card. | As corporate and government cards are often used for transactions by multiple people, these can sometimes trigger the same alerts as a user with a high number of transactions, multiple devices, and so on. |

User is paying with a prepaid card. | Since prepaid cards aren't associated with a bank account, it's difficult, if not impossible, to verify the user's identity. |